|

|

|

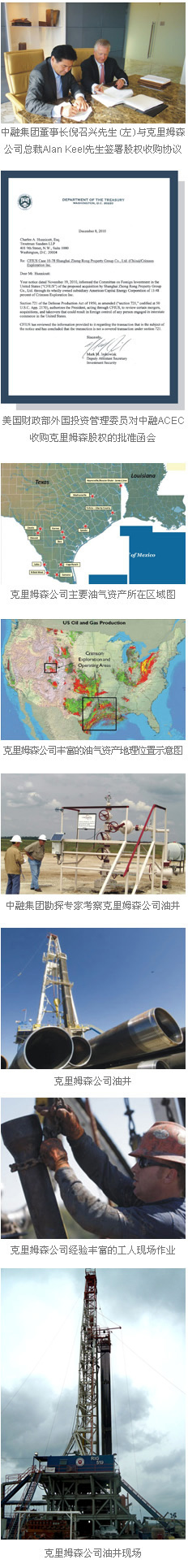

In September 2010, ACEC, a subsidiary company of Zhongrong Group, signed equity subscription agreement with Crimson Exploration Inc, a public listed company in NASDAQ, and became a substantial shareholder of Crimson Exploration Inc. This acquisition is the second successful attempt to invest in North America energy field following the establishment of CCEC, which joined the strength of financial opertation with industry experience, and offers a powerful platform for the group's future expansion in energy business in North America.

It is widely known that petroleum is the ‘blood’ of national economic development and the foremost strategic issue for all countries. During the globalization process, who controls the oil, who dominates the world! Since the reform and opening up, China's demand for petroleum is significantly increasing and has become the second largest energy consumer after the USA. In the last decade, focusing on the “ going global” strategy, the state-owned enterprises have acquired a large number of oversea oil and gas assets and become the major players in the global M&A market. However, for the reason that petroleum exploration is featured by high risk, high tech, high investment and long cycle, Chinese private companie's participation in oversea energy investment is still at an early stage. Zhongrong Group always insists on the principle of “Where there is a demand, there is the direction of our investment”; in the context of global energy shortage and continuous demand growth, the group collected information and conducted numerous analysis and research. In 2005, Zhongrong took the first step in oversea energy investment after receiving the invitation from Canadian government and the approval by the NDRC, to establish Canada Capital Energy Corp. (CCEC) which is the first non-state-owned enterprise participating in upstream oil & gas business in North America. In the past six years, led by CCEC’s Chairman Ms. Gong Jianxin, the company becomes a comprehensive independent ernergy firm engaged in geological and geophysical exploration, drilling, production and sales. CCEC has more than 100,000 acreage in Williston Basin, Southeast Saskatchewan, with oil reserves of 200 million barrels. The production is all light crude oil, when oil price is 80 dollars, the netback per barrel is up to 60 dollars, which represents the leading level among peer groups. The establishment of CCEC is the milestone of Zhongrong Group investing in oversea market, it also contributes valuable experience for the group's diversified and international development. As a private enterprise, such success also gained the support from China and Canadian government, and drew the attention from oversea and domestic industry players.

With the solid foundation and operational experience of CCEC, in 2007, Zhongrong Group founded the second petroleum company—America Capital Energy Corporation in the world financial center -New York, to seek a business model which can join the strength of energy operational experience with financial market. The U.S is the world's third largest oil producer, the largest natural gas producer, and the largest energy consumer. It is the birthplace of the modern oil industry, and has a exploration and development history of more than 150 years. It has the world most advanced technologies, excellent human resource and service market and production and sales facilities. The Group has selected Houston, Texas, the world’s important oil city, to build the division and organized a team of geologists and engineers with more than 30-year experience to select projects in Gulf of Mexico. The Gulf region is the largest and most important oil and gas producing area in the U.S, with proved oil and gas reserves of over 40% of the total U.S. reserves, and the production accounts for over 50% of the country. According to United States Geological Survey, the unproved oil and gas resources in Gulf of Mexico are 19.6 billion equivalent barrels, in the foreseeable future, here will still be the most active region with the highest production in mainland States. Crimson’s oil and gas assets are mostly located in the core area of onshore Gulf of Mexico.

Crimson Exploration Inc. is an independent energy company engaged in exploration, development, production, sales and the acquisition of oil and natural gas assets, and operates highly prospective properties in conventional oil play and emerging shale gas resource play. The company currently has about 400 wells and 100,000 acreage. In the third quarter of 2010, its daily production is around 7500 boe. According to Netherland, Sewell & Associates, Inc, the international reserve audit company, Crimson’s proved reserves (P1) is 25.71 mmboe, and the resources is estimated over 200 mmboe.

Crimson has a balanced oil and gas asset portfolio, including unconventional resources in Haynesville Shale play, east Texas, and the conventional resources in Texas, Louisiana and Colorado. The U.S has the state of art shale gas technologies. By the end of 2009, shale gas production has reached 90 billion m3, exceeding conventional natural gas annual production in China. In 2010, shale gas production accounted for more than 15% of the total U.S. natural gas production. Haynesville area is the world's third largest shale gas resource play, and one of the most important shale gas areas in the US. In 2009, Crimson drilled the first well in this region, and the initial rate was 30.70 mmcf (or 5100 boe) which is still the highest production record in Haynesville. In 2010, Crimson drilled more wells here. The average well depth is 5500m, and horizontal lateral around 1500m. The company applied innovative completion techniques which siginificantly increased the recovery rate, and the estimated ultimate recovery is nearly twice as the general wells in the region. Crimson has around 240 drilling locations in Haynesville. In addition to Haynesville play, Crimson has interests in 52000 acres and 250 oil wells in the prospective Eagle Ford play in South Texas, which is in the same resource play as CNOOC newly $ 2.16 billion deal of 600,000 acres land in Eagle Ford. China has rich shale gas resources and the similar geological conditions with the US, but commercial development of shale gas can not be commenced now due to lack of mature technology. Through the acquisition, Zhongrong will participate in Crimson’s operation and management, and will study the advanced technology of unconventional resources development, which can contribute to our nation’s development.

Besides the technology advantage of unconventional oil& gas development, Crimson’s operation in conventional regions also has good economic profit, such as Liberty County in Southeast Texas, the production is from Yehua formation in Eocene. Geologically, it has abnormally high pressure, the porosity exceeds 30% and permeability is 200~600 md. The production rate of single well is very promising in this region. In 2010, the daily production of Crimson’s newly drilled wells is around 1500 boe (725 bbl of oil and 5 mmcf), payout time is only 6 to 9 months. Another advantage of the company is its high-quality 3D seismic data which can accurately define the complex underground situations, so its drilling success rate is above 90%.

Zhongrong Group grasped the opportunities when financial crisis and oil crisis occurred in the end of 2008. It compared several potential targets and conducted detailed analysis to finally focus on one company, and then approached Crimson’s management and shareholders to negotiate the deal. Meanwhile, Zhongrong hired “CNPC Engineering Consulting Company” to prepare the project feasibility report. The report was then reviewed and appraised by “China International Engineering Consulting Corporation” appointed by NDRC, and then the project proposal was approved by NDRC. In the U.S.A, Zhongrong’s investment strategy and energy operational experience was appreciated by Crimson’s management and its largest shareholder- Oaktree Capital. With their cooperation, Zhongrong Group and ACEC prepared to file the equity investment to CFIUS (The Committee on Foreign Investment in the United States) and to promote the transaction. CFIUS is an inter-agency committee of the United States Government that reviews the national security implications of foreign investments in U.S. companies or operations. Chaired by the Secretary of the Treasury, CFIUS includes representatives from eight federal departments and agencies, including the State, Defense, and Commerce. Zhongrong Group successfully got approval from CFIUS, and became the first Chinese enterprise officially approved for equity investment in US listed oil company and entering into the core oil and gas region to participate into the upstream business in the US.

Zhongrong Group's equity investment in Crimson is another important energy investment following CCEC. It signified that Zhongrong not only has the ability to operate independent oil company, but also entered into M&A market, to realize a development model of combining industry experience with capital operation. This acquisition offers a better platform for group’s further expansion in North America energy business and guides the direction for controlling high-quality oil assets through capital market.

After the equity investment, Crimson’s share price has increased by 50% to the date, which illustrate market confidence and active reaction to Zhongrong. The Group and ACEC will continually support Crimson’s furture development with funds and strategies. As a beginning, Zhongrong also established good partnership with Oaktree Associates (global assets under management exceed 78 billion dollars) and will create more all-rounded cooperation chances in energy, real estate, and financial investment.

The equity investment embodies the consistent oversea investment strategy of Zhongrong Group that focuses on selecting and controlling projects with an eye of sustainable development and the ability of leading an international team. Zhongrong studies and uses international and domestic resources to suit the markets of China and the U.S., and observes the laws,regulations and business practice. Zhongrong Group also has learned much from practice. In the meanwhile, its precision, professional, and friendly and prudent investment strategy has again been praised and supported from the governments of China and the U.S.